Shanghai Weekly Bulletin (Issue 56, No.1, August 2024) ( 2024.08.07 )

Issue 56

Shanghai Weekly Bulletin

No.1,August 2024

Shanghai Weekly Bulletin is an information service presented by the Foreign Affairs Office of Shanghai Municipal People’s Government in collaboration with Wolters Kluwer to foreign-funded enterprises, foreign-related institutions as well as people from overseas living in Shanghai. Covering major national and Shanghai foreign-related news, event information, policy Q&A and interpretations in the past week, it keeps you up-to-date with the latest foreign-related policies and developments in Shanghai.

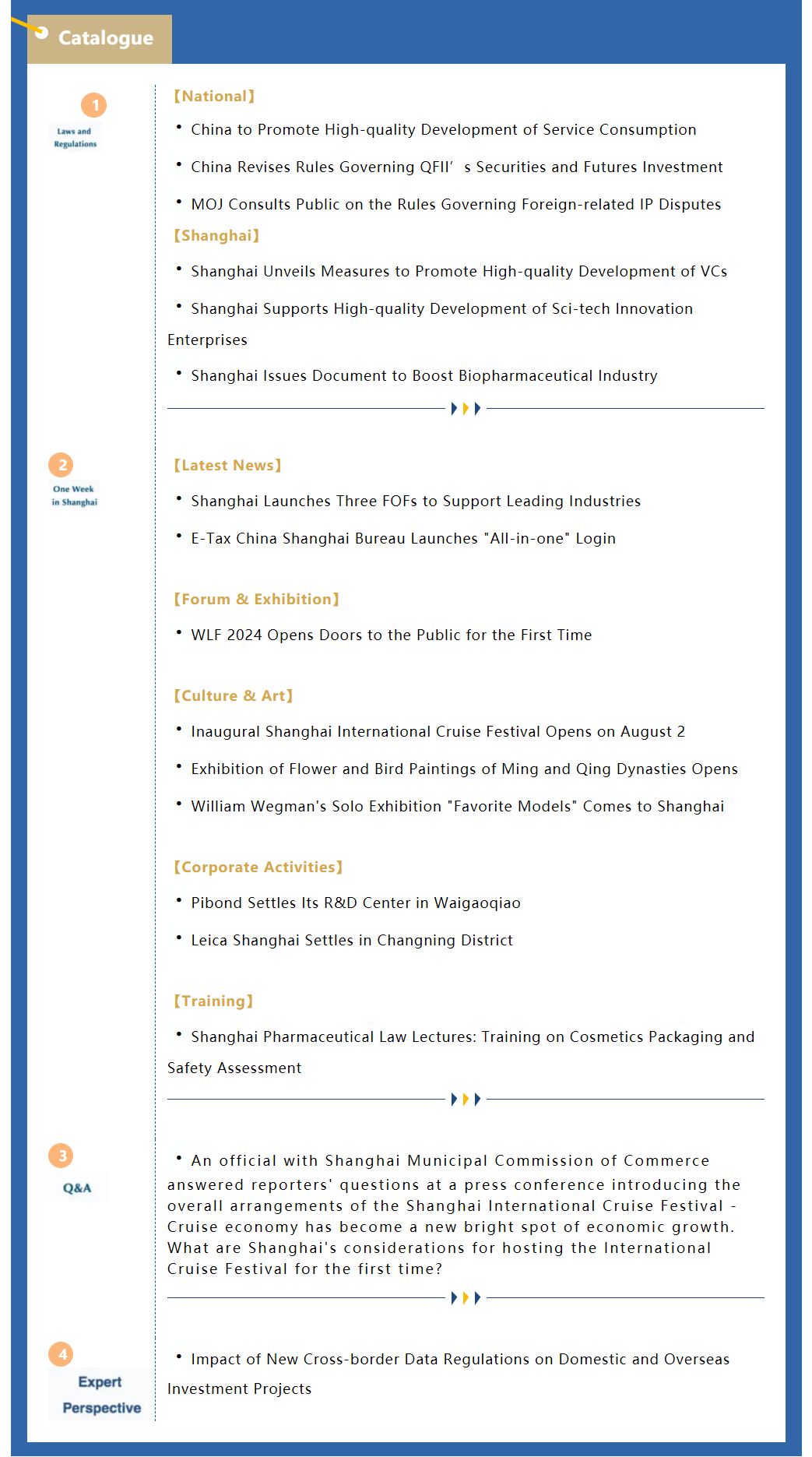

Laws and Regulations

【National】

1. China to Promote High-quality Development of Service Consumption

【Keywords: Service Consumption】

China’s State Council recently issued the Guidelines on Boosting the High-quality Development of Service Consumption. The document calls for tapping the potential of basic consumption, fostering and boosting new types of consumption, injecting new impetus into service consumption, improving service consumption environment, and stepping up policy support. It also stresses the need to align domestic rules with high-standard international economic and trade rules, relax market access restrictions for the service sector, deepen the opening-up of the fields such as telecommunications, education, aged care, and medical care, and promote the comprehensive implementation of opening-up measures in the fields of technology services and tourism.

Source:International Shanghai Services

https://english.shanghai.gov.cn/en-Latest-WhatsNew/20240805/7b30b65439a942a0ad3aa7d0b3b8d609.html

2. China Revises Rules Governing QFII’s Securities and Futures Investment

【Keywords: QFII】

The People's Bank of China (PBC) and the State Administration of Foreign Exchange (SAFE) recently released the revised Provisions on the Administration of Chinese Domestic Securities and Futures Investment by Qualified Foreign Institutional Investors, which are scheduled to take effect on August 26, 2024. The revised document further streamlines business registration procedures, optimizes account management, improves foreign exchange management, and aligns the foreign exchange risk management framework for qualified foreign institutional investors (QFII) and RMB qualified foreign institutional investors (RQFII) scheme with the direct entry into the China Inter-bank Bond market (CIBM).

Source:PBC

http://www.pbc.gov.cn/goutongjiaoliu/113456/113469/5414940/index.html

3. MOJ Consults Public on the Rules Governing Foreign-related IP Disputes

【Keywords: Foreign-related Intellectual Property】

The Ministry of Justice (MOJ) released on July 29, 2024 the Provisions of the State Council on the Resolution of Foreign-related Intellectual Property Disputes (Exposure Draft) to seek public opinions until August 28, 2024. The document consists of 12 articles, with provisions that strengthen the guidance and services for the resolution of foreign-related intellectual property (IP) disputes, enhance information services, and step up enterprise capacity building.

Source:MOJ

https://www.moj.gov.cn/pub/sfbgwapp/lfyjzjapp/202407/t20240729_503613.html

【Shanghai】

1. Shanghai Unveils Measures to Promote High-quality Development of VCs

【Keyword: Venture Capital Development】

Shanghai Municipal People’s Government recently issued the Guidelines on Further Promoting the High-quality Development of Shanghai-based Venture Capitals (VCs), which took effect on August 1,2024 and will remain valid until July 31, 2029. The document introduces 19 measures in four aspects, including giving leading roles to government investment funds, facilitating the coordinated development of VCs and the multi-layered financial service system, promoting the synergy between VCs and the development of industries and specific regions, and stepping up talent and policy support.

Source: International Services Shanghai

https://english.shanghai.gov.cn/en-Latest-WhatsNew/20240801/875d7cfe107444aaa02234eefaf9b813.html

2. Shanghai Supports High-quality Development of Sci-tech Innovation Enterprises

【Keywords: Sci-tech Innovation Enterprises】

Shanghai Municipal People’s Government issued on July 30, 2024 the Guidelines on Leveraging Capital Markets to Promote the High-quality Development of Shanghai-based Sci-tech Innovation Enterprises, which took effect on July 30, 2024. The document calls for developing Shanghai into an investment and financing cluster to lead the development of new qualify productive forces, a demonstration hub for the high-quality development of listed companies, and a pioneering zone for the healthy and regulated development of capital markets within five years, so as to better serve Chinese modernization.

Source:Shanghai Municipal People’s Developmen

https://www.shanghai.gov.cn/nw12344/20240731/ed54dcbe329049198722f797ec60d4cc.html

3. Shanghai Issues Document to Boost Biopharmaceutical Industry

【Keywords: Biopharmaceutical】

Shanghai Municipal People’s Government recently released the Guidelines on Supporting the Innovation-driven Development of the Biopharmaceutical Industry Along the Whole Chain, which took effect on August 1, 2024 and will remain valid until July 31, 2029. The document introduces 37 policy measures in eight aspects, including making greater effort to strengthen original innovation capability, empowering the industrial development with clinical resources, further expediting reviews and approvals, promoting the application of innovative products, and strengthening support in serving businesses and implementing industrialization.

Source:Shanghai Municipal People’s Government

https://www.shanghai.gov.cn/nw12344/20240730/0fe29fc2246e4b478757dee3a01ccd08.html

One Week in Shanghai

【Latest News】

1. Shanghai Launches Three FOFs to Support Leading Industries

【Keywords:FOFs Targeting Leading Industries】

Shanghai announced on July 26, 2024 the launch of three funds of funds (FOFs) targeting leading industries. With a total size of 100 billion yuan, the three FOFs aim to support integrated circuits (IC), biopharmaceuticals, AI and future industries. The funds will be managed by professional investment teams to invest in technology-based enterprises in earlier stage, startups and hard technologies, foster industries, conduct mergers and acquisitions, and strengthen the supply chains of the leading industries through sub-fund investment, direct investment, and other modes of operations.

Source:Shanghai Release

2. E-Tax China Shanghai Bureau Launches "All-in-one" Login

【Keywords: All-in-one】

E-tax China Shanghai Bureau has launched the “all-in-one” login, a move to simplify the login entrance and make login more convenient and faster. The feature merges five entrances for enterprise business, natural person business, agency business, non-resident enterprise login, and overseas natural person login into one, effectively improving the login efficiency.

Source:E-tax China Shanghai Bureau

【Forum & Exhibition】

1. WLF 2024 Opens Doors to the Public for the First Time

【Keywords: World Laureates Forum】

The World Laureates Forum (WLF) 2024 will be held at its permanent site in Lingang Special Area from October 25 to 27. For the first time, the forum will open its doors to the public, offering a unique opportunity for individuals to engage with laureates of Nobel Prize, Turing Award, and Wolf Prize. It will also try to seek the participation of universities, scientific research institutions and sci-tech innovation enterprises in the forum as teams.

Source:International Services Shanghai

https://english.shanghai.gov.cn/en-Latest-WhatsNew/20240730/bb92f3bb3f3a41f1922865a8d61765f5.html

【Culture & Art】

1. Inaugural Shanghai International Cruise Festival Opens on August 2

【Keywords: Shanghai International Cruise Festival】

The inaugural Shanghai International Cruise Festival kicked off on August 2 and will last until August 31. As one of the seven benchmark events during the "Shanghai Summer" International Consumption Season, the festival will link key business districts across the city, mobilize market players, adopt market-oriented strategies, and launch the "Hand in Hand" theme event to showcase the characteristics of cruise ships and promote the deep integration of cruise economy and cruise culture.

Source:International Services Shanghai

https://english.shanghai.gov.cn/en-MajorConsumerEvents/20240802/8a26c552f6f34ac09400f19648c8cdc1.html

2. Exhibition of Flower and Bird Paintings of Ming and Qing Dynasties Opens

【Keywords: Flower and Bird Paintings of Ming and Qing Dynasties】

An exhibition of flower and bird paintings of Ming and Qing dynasties, which is titled “Brilliant Red Hither and Lush Green Thither: Expressive Brushstrokes in Flower and Bird Paintings of the Ming and Qing Dynasties”, opened at Cheng Shifa Art Museum on July 30 and will last until November 17. The exhibition brings together 49 exquisite flower and bird paintings by well-known artists from Ming and Qing dynasties, such as Shen Zhou, Chen Chun, Tang Yin, Chen Hongshou, Shi Tao, Jin Nong, Li Shan, Xu Gu, Pu Hua and Wu Changshuo. It is divided into three units, namely "one flower and one fruit expresses the spirit", "being different and innovative to create a unique style" and "the brush creates colorful flowers and presents extraordinary colors.”

Source: Shanghai Chinese Painting Academy

3. William Wegman's Solo Exhibition "Favorite Models" Comes to Shanghai

【Keywords: William Wegman】

Artist William Wegman's solo exhibition "Favorite Models" opened at the Fosun Foundation in Shanghai on July 27, 2024. As an important part of the fourth "Bund Art Season" in 2024, the exhibition is set to present a series of representative photographs by William Wegman in collaboration with his pet dog. The Polaroid 20x24 large-format camera, an important creative medium for the artist, will also make its first public appearance in Shanghai at the exhibition.

Source:Fosun Foundation

【Corporate Activities】

1. Pibond Settles Its R&D Center in Waigaoqiao

【Keywords: Pibond】

Pibond has settled its Shanghai R&D Center in Waigaoqiao New Exhibition City 3.0 Industrial Community. It will create cleanrooms and R&D analysis rooms, laboratories, advanced production area, material staging area and auxiliary facilities in the center. Once completed, the project will enhance Pibond China's local R&D and production capabilities and promote the development of new quality productive forces.

Source:Pudong Release

2. Leica Shanghai Settles in Changning District

【Keywords: Leica】

On July 30, at the 2024 "Investing in Hongqiao" event and the "Hongqiao International Central Business District Investment Promotion Conference 2024", Leica Biotech (Shanghai) Co., Ltd. signed an agreement for its settlement in the Changning area. The company will become the operation headquarters of Leica's pathology diagnostic equipment and consumables sales business segment in China, featuring sales, operations, market strategy, R&D and others.

Source:Shanghai Observer

https://www.shobserver.com/staticsg/res/html/web/newsDetail.html?id=778375&v=1.3&sid=67

【Training】

1.Shanghai Pharmaceutical Law Lectures: Training on Cosmetics Packaging and Safety Assessment

【Keywords: Cosmetics】

Shanghai Medical Products Administration and Shanghai Packaging Materials Institute plan to hold the Shanghai Pharmaceutical Law Lectures: Technical Training on Cosmetic Packaging and Safety Assessment on August 21, 2024, so that relevant companies and institutions can understand the latest policies and requirements, and make technical preparations for the transition from the old to the new assessment reports.

Source: Shanghai Medical Products Administration

Q&A

1: An official with Shanghai Municipal Commission of Commerce answered reporters' questions at a press conference introducing the overall arrangements of the Shanghai International Cruise Festival - Cruise economy has become a new bright spot of economic growth. What are Shanghai's considerations for hosting the International Cruise Festival for the first time?

A1: Since the resumption of global cruise services, the international cruise market has seen quick recovery. Shanghai has seized the window period of the resumption and strengthened its policy support. Last year, we issued a three-year action plan for the high-quality development of the cruise economy, further strengthening the service support. Since Shanghai cruise ships resumed operations a year ago, Shanghai International Cruise Port has received more than 600,000 tourists, effectively boosting cruise trade, consumption and employment in related sectors, and becoming a new engine for economic growth. The first Shanghai International Cruise Festival aims to promote cruise culture through festive activities and showcase the vitality and charm of cruise ship travel, which is of great significance for unleashing consumption potential, cultivating new development momentum, and pushing for high-standard opening up.

First, we will promote innovation in the cruise industry and push for the high-quality development of the cruise economy. Cruise home ports or visiting ports are usually cities with abundant tourism resources. With the commercial operation of large domestic cruise ships, the increase in cruise operators and the return of foreign-owned cruise ships, there is a huge demand for onshore tourism products to enhance cruise passengers' experience and expand the value chain of cruise services. Therefore, holding a cruise festival can promote the "cruise +, + cruise" business model innovation, product innovation and service innovation, and empower the high-quality development of Shanghai's cruise economy.

Second, cruise services can spur spending by foreigners and drive consumption upgrade. Cruise ships are a new carrier for high-end tourism service consumption, and a new field that meets the people's pursuit for a better life and promotes consumption upgrade. Foreign tourists make larger contribution in cruise travel spending. Statistics show that 75% of the inbound and outbound passengers at Shanghai Cruise Port are tourists from other places or abroad. Therefore, holding a cruise festival can not only demonstrate the unique charm of Shanghai as an international consumption hub and expand foreign consumption, but also unleash the potential of high-end consumption and spur new consumption momentum.

The third is to enhance the influence of Shanghai International Cruise Port and promote high-standard opening up. From the perspective of international shipping business, cruise ships are highly internationalized, so they have a high visibility in promoting opening up. Since the start of this year, relevant state departments have introduced a series of facilitation measures and support policies to drive the cruise economy. Currently, Royal Caribbean Cruises and MSC Mediterranean Cruises have returned to Shanghai to start home port operations. Holding a cruise festival is also an important window and carrier for promoting China's cruise policies. It is helpful for more cruise companies to understand the cruise policies. At the same time, from the perspective of consumers, it will optimize the operating details and convenience, demonstrate the vitality of Shanghai's cruise economy, attract more international cruise operators to settle in Shanghai, and enhance the influence and competitiveness of Shanghai Cruise Port.

Source: Information Office of Shanghai Municipality

https://www.shio.gov.cn/TrueCMS/shxwbgs/2024n_7y_wdsl/content/f81429ef-d803-4b81-beec-9edace22af17.html

Expert Perspective

Impact of New Cross-border Data Regulations on Domestic and Overseas Investment Projects

By: Fu Peng, Yu Qin, Wei Longjie (Haiwen& Partners)

[Continuing from the Last Issue]

III Impact of the New Rules on Private Equity Investments or Takeover Projects

(1)Practical handling of cross-border data reporting for investment and M&A projects before the release of the new rules

As mentioned in the last issue, before the release of the new rules, the scope of application of compliance reporting obligations in cross-border data transmission was relatively broad and there were gray areas. This may result in a large number of scenarios requiring cross-border data compliance reporting. Therefore, target companies (i.e. data processors) in a large number of equity investments or M&A projects generally need to conduct cross-border data compliance reporting once data crosses the border, but it is difficult for them to accurately grasp whether they have important data to be transferred out of China and how the data can be transferred outbound.

In contrast to the uncertainty of the application of the aforementioned compliance obligations, the cross-border data compliance reporting procedures may indeed have a substantial impact on the timetable of investment and M&A projects, such as affecting transaction certainty and even transaction willingness. From the perspective of rules alone and without considering the time required for the preparation of reporting materials, the review period for standard contracts on personal information is 15 business days. If additional materials are required, the applicant shall present within 10 business days. The duration of data outbound security assessment is longer, usually completed within 57 business days, but it can be extended if the national cybersecurity department believes that additional materials are needed or the situation is complicated. According to the multiple data outbound security assessment projects and personal information standard contract filing projects handled by the author, the actual time spent is much longer than the above time.

In some investment and M&A projects, especially those involving target companies with the need for cross-border data transfer (e.g., data that needs to be transferred to R&D and design centers or test and laboratory centers located overseas, personal information of employees or customers that needs to be transferred to affiliated companies located overseas for analysis and processing, data that needs to be transferred to suppliers or customers overseas for delivery, etc.), investors may consider the following based on the situation of each case:

The fulfillment of cross-border data compliance reporting obligations will be made one of the prerequisites for project delivery. If it is expected that such obligations are unlikely to be fulfilled in a short period of time, that there is an urgent need to implement the project, and that there are multiple payment arrangements by investors, then the fulfillment of cross-border data compliance reporting obligations will be considered as a prerequisite for investors to pay the second, third or other non-first payment. This arrangement is common in sectors processing sensitive data or a large amount of data, or investment and M&A projects with applicable data export channels.

The target company will complete the cross-border data compliance declaration obligation as one of its post-closing commitments. That is, the target company and investors expect that under the expected timetable, the decision to wait until the target company completes all cross-border data compliance declarations before closing may not meet the market development or corporate financing needs.

Investors may require the target company to promise that it will properly fulfill the cross-border data compliance reporting obligations within a given reasonable time limit and bear the contractual liability for failure to perform such obligations on time or being monitored and punished by the competent authorities during this period. Such arrangement is common in investment and M&A projects where the target company does not involve sensitive data, the amount of data to be processed is small, or the applicable data export channels are not yet clear.

[To Be Continued]