Shanghai Weekly Bulletin (Issue 57, No.2, August 2024) ( 2024.08.14 )

Issue 57

Shanghai Weekly Bulletin

No.2,August 2024

Shanghai Weekly Bulletin is an information service presented by the Foreign Affairs Office of Shanghai Municipal People’s Government in collaboration with Wolters Kluwer to foreign-funded enterprises, foreign-related institutions as well as people from overseas living in Shanghai. Covering major national and Shanghai foreign-related news, event information, policy Q&A and interpretations in the past week, it keeps you up-to-date with the latest foreign-related policies and developments in Shanghai.

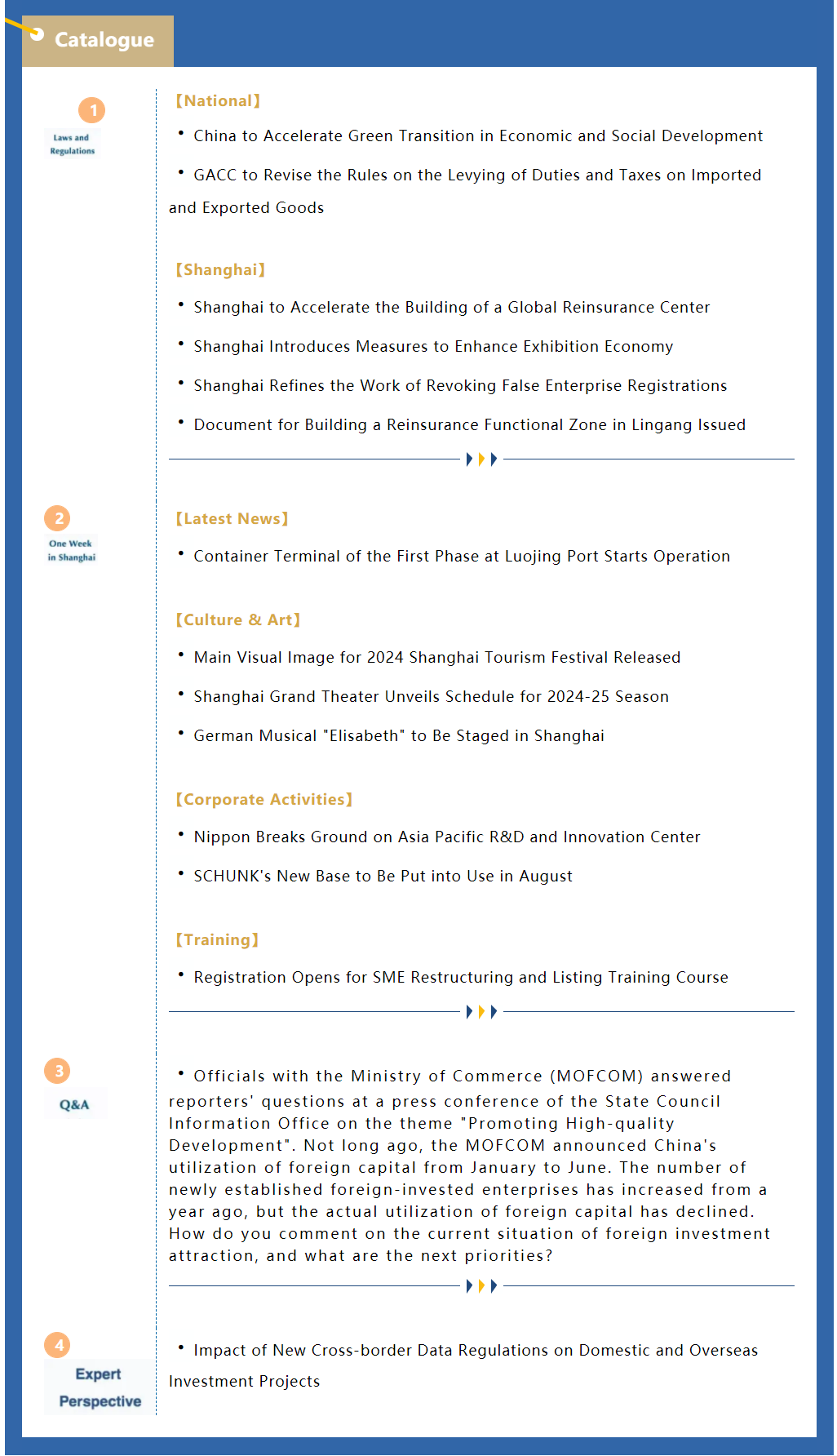

Laws and Regulations

【National】

1. China to Accelerate Green Transition in Economic and Social Development

【Keywords: Green Transition】

The Central Committee of the Communist Party of China (CPC) and the State Council released on August 11, 2024 the Guidelines for Accelerating a Comprehensive Green Transition in all Areas of Economic and Social Development. Focusing on three links in five sectors, the document calls for moving faster to develop energy-saving and environmentally friendly territorial space, industrial structure, and modes of production and lifestyles.

Source:Website of the Chinese Government

https://www.gov.cn/zhengce/202408/content_6967665.htm

2. GACC to Revise the Rules on the Levying of Duties and Taxes on Imported and Exported Goods

【Keywords: Imported and Exported Goods; Taxation】

The General Administration of Customs of China (GACC) recently released the Rules of the General Administration of Customs of the People’s Republic of China on the Levying of Duties and Taxes on Imported and Exported Goods (Revised Exposure Draft) to gather public opinions until September 2, 2024. The revised draft makes revisions in 13 aspects, including fully implementing the "self-declaration and self-payment" system, clarifying the declaration and tax payment obligations for royalties, adjusting the applicable dates of tax rates and exchange rates, increasing tax declaration requirements for taxpayers, adding deadlines for consolidated tax payments, improving the provisions on late fine refund, introducing provisions on customs tax confirmation, and implementing tax risk classification and disposal.

Source:GACC

http://gdfs.customs.gov.cn/customs/302452/302329/zjz/6022962/index.html

【Shanghai】

1. Shanghai to Accelerate the Building of a Global Reinsurance Center

【Keyword:Reinsurance Center】

The National Financial Regulatory Administration (NFRA) and Shanghai Municipal People’s Government recently issued the Guidelines to Accelerate the Building of an International Reinsurance Center in Shanghai. The document highlights five policy measures, including providing policy support for more qualified institutions to establish reinsurance operation centers, implementing the rules for releasing cross-border reinsurance premium statistics, promoting the unified registration of information, developing the reinsurance market with prudent and well-ordered steps, and enhancing the role of reinsurance in securing key sectors.

Source:International Services Shanghai

https://english.shanghai.gov.cn/en-Policies/20240806/12a91157160c4b709cd9861d3a7d5815.html

2. Shanghai Introduces Measures to Enhance Exhibition Economy

【Keywords: Exhibition Economy】

Shanghai Municipal People’s Government recently issued the Measures on Enhancing Shanghai’s Exhibition Economy and Its Impact on Various Sectors. The document took effect on August 1, 2024 and will remain valid until December 31, 2025. Highlighting nine measures, it pledges to offer up to 2 million yuan in funds for internationally renowned exhibitions that make debuts in Shanghai with a display area of no less than 50,000 square meters, particularly those ranked among the world’s top 100 trade shows or certified by the Global Association of the Exhibition Industry (UFI).

Source:International Services Shanghai

https://english.shanghai.gov.cn/en-Latest-WhatsNew/20240808/7602e4c988f745ca9d61dbdffffef3f7.html

3. Shanghai Refines the Work of Revoking False Enterprise Registrations

【Keywords: False Enterprise Registrations】

Shanghai Municipal Administration for Market Regulation recently issued the Implementation Measures for the Revocation of False Enterprise Registrations by Shanghai Municipal Administration for Market Regulation (for Trial Implementation). The document clarifies the jurisdiction principles for the revocation of false registrations, and explains the application and acceptance requirements. It also refines the investigation procedures and disposal processes, highlighting the effective connection between registration and supervision. The document will take effect on August 23, 2024 and remain valid until August 22, 2026.

Source:Shanghai Municipal Administration for Market Regulation

https://scjgj.sh.gov.cn/007/20240801/2c984a7290b92f7801910d2274447c68.html

4. Document for Building a Reinsurance Functional Zone in Lingang Issued

【Keywords: Reinsurance Functional Zone】

The Several Measures to Support the Building of a Functional Zone for International Reinsurance Business in Lingang Special Area of the China (Shanghai) Pilot Free Trade Zone were issued on August 2, 2024. The document proposes 18 measures in five aspects, including creating a global reinsurance center, consolidating the infrastructure for the reinsurance industry, enhancing the global competitiveness of Chinese domestic reinsurance companies, enriching reinsurance product supply and enhancing product innovation, and further attracting and nurturing reinsurance talents.

Source:International Services Shanghai

https://english.shanghai.gov.cn/en-Policies/20240808/3ee8de8e0e5b4467a109707647c95aec.html

One Week in Shanghai

【Latest News】

1. Container Terminal of the First Phase at Luojing Port Starts Operation

【Keywords:Container Terminal】

The container terminal of the first phase at the Luojing Port, which is an important part of Shanghai’s international shipping center development, was put into operation on August 7, 2024. By consolidating the position of Shanghai Port as a hub and improving the cargo collection and distribution system, the terminal will support the nation’s dual circulation development and the development of Yangtze River Economic Belt, as well as serving China's high-standard opening up.

Source: China (Shanghai) Pilot Free Trade Zone

【Culture & Art】

1. Main Visual Image for 2024 Shanghai Tourism Festival Released

【Keywords: Shanghai Tourism Festival】

The 2024 Shanghai Tourism Festival will be held from September 14 to October 6, and the main visual image of this year's festival was released a few days ago. Continuing the mission of “being a festival for the people” and themed on "embracing beauty and happiness", the 35th festival will launch some 100 themed tour products in eight categories to transform more urban resources into cultural and tourism resources, so as to attract more domestic and foreign tourists for travel and spending.

Source:Shanghai Tourism

2. Shanghai Grand Theater Unveils Schedule for 2024-25 Season

【Keywords: Shanghai Grand Theater】

Shanghai Grand Theater unveiled on August 7 the performance schedule of its 2024-25 season. The new season will feature 514 Chinese and foreign performances of 71 productions. Following its tradition, the theatre has curated a “Top 10 Must-see” list, featuring performances led by masters and famous artists and spanning a wide range of genres including opera, symphony, ballet, original musicals and solo concerts.

Source: International Services Shanghai

https://english.shanghai.gov.cn/en-CulturalPerformances/20240809/650b3f07fcd04ad294c82118ce0aa8d5.html

3. German Musical "Elisabeth" to Be Staged in Shanghai

【Keywords: Elisabeth】

The German musical "Elisabeth" made its debut in China in December 2014, opening the door to German musicals for Chinese audience and becoming a beloved classic for numerous fans. After a 10-year absence, "Elisabeth" will return to the stage of Shanghai Culture Square from August 29 to September 15 in the new form of staged concert, presenting 21 fabulous musical shows to the long-awaited audience.

Source:Shanghai Culture Square

【Corporate Activities】

1. Nippon Breaks Ground on Asia Pacific R&D and Innovation Center

【Keywords: Nippon】

The groundbreaking ceremony for Nippon Paint's Asia Pacific R&D and innovation center and magic paint packaging base was held in Pudong on August 3, 2024. As an important part of Nippon Paint's global R&D and manufacturing system, the project will guarantee product innovation, R&D and implementation, further deepen Nippon Paint's core strategy of "in China, for China", and at the same time fulfill its firm commitment of "in China, for the world", accelerating the vigorous development of the coatings industry.

Source:Pudong Release

2. SCHUNK's New Base to Be Put into Use in August

【Keywords: SCHUNK】

The new production base for depaneling and automation products of SCHUNK Precision Machinery Trading (Shanghai) Co., Ltd. has been completed and is expected to be put into use at the end of August. This base covers a total area of 4,717 square meters, with an investment of RMB 60 million. It integrates office, R&D, production and warehousing. It is SCHUNK's first manufacturing center in the Asia-Pacific region and the group's 10th factory worldwide.

Source:Minhang Today

【Training】

1.Registration Opens for SME Restructuring and Listing Training Course

【Keywords: Restructuring and Listing】

The Shanghai Investment Promotion Service Center (Shanghai Small and Medium-sized Enterprises Listing Promotion Center) plans to hold the "Pujiang Light" series of training (the 44th session) for the restructuring and listing of 100 small and medium-sized enterprises (SMEs) from August 28 to 30, in an effort to provide targeted services for corporate listing and help high-quality enterprises to get access to the STAR Market and other major capital markets.

Source: Invest Shanghai

Q&A

1: Officials with the Ministry of Commerce (MOFCOM) answered reporters' questions at a press conference of the State Council Information Office on the theme "Promoting High-quality Development". Not long ago, the MOFCOM announced China's utilization of foreign capital from January to June. The number of newly established foreign-invested enterprises has increased from a year ago, but the actual utilization of foreign capital has declined. How do you comment on the current situation of foreign investment attraction, and what are the next priorities?

A1: In the first half of this year, the actual utilization of foreign capital in China was close to RMB 500 billion, which is still at a relatively high level in the past decade. Frankly speaking, the amount of foreign investment has declined year-on-year, mainly due to the higher base of the same period last year.

From a structural perspective, the structure of foreign investment is being optimized. The actual proportion of foreign investment in China's high-tech manufacturing industry increased by 2.4 percentage points compared with the same period last year, and the proportion of foreign investment in the manufacturing industry also increased by 2.4 percentage points compared with a year ago. The figures indicate that the structure is being optimized and that foreign investors are actively adjusting their investment in China, which is completely consistent with the general trend of China accelerating the development of new quality productive forces and advancing the industrialization drive.

It can be seen that the basic trend of economic recovery has not changed. The comprehensive advantages of super-large market, high-quality industrial system, and high-end and high-quality talent supply have not changed its attractiveness to foreign investment. Most multinational companies are upbeat about the prospects of long-term investment in China, so they continue to increase their investment. As you just said, the number of newly established foreign-invested enterprises was nearly 27,000 in the first half of this year, a year-on-year increase of 14.2%. This figure shows the level of robust activity and continues the trend of rapid growth in the number of foreign-invested enterprises since last year.

In the next stage, we will increase efforts to attract and utilize foreign investment, and leverage high-standard opening up to promote in-depth reforms and drive high-quality development. Specifically, we are making efforts in the following aspects:

Firstly, we will steadily expand institutional opening-up. As I just mentioned when introducing the pilot free trade zones, the free trade zones play a vital role in attracting foreign investment, accounting for a significant 20.8% share, so the work of the free trade zones is also an important part of luring foreign investment. Mainly through the free trade zones and free trade ports, we will actively align with high-standard economic and trade rules, achieve the interoperability of rules, regulations, management and standards in multiple fields, leverage the demonstration role of the free trade zones and the Hainan Free Trade Port, and promote proven pilot measures to other free trade zones across the country.

Secondly, we will further relax market access restrictions. We plan to expand the catalogue of industries that encourage foreign investment, release the 2024 version of the negative list for foreign investment, and implement the General Secretary's statement to completely cancel all restrictions on foreign investment access in the manufacturing sector, that is, to have “zero” investment restrictions on manufacturing across the country. At the same time, based on our own development needs, we will promote orderly opening up in the sectors of telecommunications, Internet, education, culture, and healthcare. We will also revise the Measures for the Administration of Strategic Investment in Listed Companies by Foreign Investors, to guide more high-quality foreign investors into the capital market for long-term investment.

Thirdly, we will deepen the reform of the foreign investment promotion system and mechanism. We will build the "Invest China" brand, improve the effect of key investment exhibitions including the Xiamen 98 Investment Fair and landmark events, improve the performance evaluation system on foreign investment promotion, support local innovations in investment promotion models, leverage advantageous areas to improve targeted investment promotions, and attract more high-quality foreign investment.

Fourthly, we will build various open platforms. We will promote the comprehensive pilot demonstration of expanding opening-up of the service industry. We will launch pilot measures to increase the intensity of opening up and innovation in the fields of value-added telecommunications services, healthcare, digital economy, cultural tourism and transportation, commercial aerospace, and distinctive consumption. This year marks the 40th anniversary of the establishment of the first batch of national economic development zones. We will build high-quality national economic development zones, which will play a greater role in developing an open economy and fostering new quality productive forces.

Fifthly, we will continue to improve foreign investment environment. We will carry out annual evaluations on the implementation of the Guidelines of the State Council on Further Improving the Foreign Investment Environment and Increasing Efforts to Attract Foreign Investment, so as to make sure every policy measure will be properly implemented. In the meantime, we will improve the foreign-invested enterprise roundtable system and the foreign investment complaint mechanism, help enterprises address their difficulties, ensure that foreign-invested enterprises enjoy national treatment in terms of factor acquisition, qualification licensing, standard setting, and government procurement, and share the dividends of China's reform and opening up.

Source: State Council Information Office

http://www.scio.gov.cn/live/2024/34415/tw/

Expert Perspective

Impact of New Cross-border Data Regulations on Domestic and Overseas Investment Projects

By: Fu Peng, Yu Qin, Wei Longjie (Haiwen & Partners)

[Continuing from the Last Issue]

III Impact of the New Rules on Private Equity Investments or Takeover Projects

(2) Options for cross-border data reporting for investment and M&A projects after the release of the new regulations

After the release of the new regulations, the bottom-line provisions of Article 38 of the Personal Information Protection Law, "other conditions as stipulated by the national cybersecurity department", have been linked to substantially narrow the scope of cross-border data compliance reporting, and by clarifying the conceptual boundaries of "important data", the scope of application of security assessment on outbound data transfer, which has the most significant impact on the timetable of investment and M&A projects and is the most difficult to be reported, has been explained. This part of the content has been discussed in the previous article and will not be repeated here.

Based on the new regulations, we expect that the uncertainty brought by the compliance reporting obligations in cross-border data scenarios to investment and M&A projects will be significantly reduced. On one hand, the timetable for investment or M&A projects will be more predictable, and the administrative procedures that restrict the progress of transactions may be simplified; the application and negotiation of special data compliance clauses by related parties are expected to be reduced.

As mentioned above, the new regulations stipulate that under certain circumstances (such as those necessary for contract performance, cross-border human resources management, protection of personal and property safety, and cross-border transfer of a small amount of non-sensitive personal information by non-critical infrastructure operators) data transfer reporting is not required, which essentially exempts some target companies that have daily, non-sensitive, and small-amount data transfers from their compliance obligations.

Accordingly, the necessity of setting up clauses in transaction documents that require the target company to fulfill its cross-border data compliance reporting obligations before obtaining financing, or that it must fulfill its reporting obligations within a certain period of time, through mechanisms such as delivery preconditions and post-delivery commitments, has been significantly reduced.

On the other hand, due to the existence of a mechanism for exemption from cross-border data compliance reporting obligations, the target companies of relevant investment or M&A projects need to demonstrate, and investors also need to judge, whether the data processing situations fall within the scope of exemption; this may trigger negotiations on new transaction terms.

For example, if a target company claims that it does not need to fulfill cross-border data compliance reporting obligations, investors may consider making special arrangements in the terms of the transaction documents; such as:

requiring the target company to make representations and warranties in the transaction documents, for example, stating that the target company's cross-border data transfer activities before the closing date do not require the filing of standard contracts for the outbound transfer of personal information, personal information protection certification, or security assessment on outbound data transfer; and

requiring the target company to make appropriate commitments in the transaction documents. For example, it should commit that when it is required by any competent authorities or applicable normative document to make cross-border data compliance reporting, it should fulfill relevant obligations within the time given by investors or required by relevant regulatory documents (whichever is earlier).

[To Be Continued]