Shanghai Weekly Bulletin (Issue 82 No.2, February 2025) ( 2025.02.19 )

Issue 82

Shanghai Weekly Bulletin

No.2,February 2025

Shanghai Weekly Bulletin is an information service presented by the Foreign Affairs Office of Shanghai Municipal People’s Government in collaboration with Wolters Kluwer to foreign-funded enterprises, foreign-related institutions as well as people from overseas living in Shanghai. Covering major national and Shanghai foreign-related news, event information, policy Q&A and interpretations in the past week, it keeps you up-to-date with the latest foreign-related policies and developments in Shanghai.

Laws and Regulations

【National】

1. Tourist Groups From ASEAN Countries Can Enter Xishuangbanna, Yunnan Without a Visa From February 10, 2025

【Keywords: ASEAN, Visa-free】

Recently, the National Immigration Administration (NIA) issued a notice implementing a visa-free policy for ASEAN tourist groups entering Xishuangbanna, Yunnan Province. Effective from February 10, 2025, tourist groups (of 2 or more ordinary passport holders) from 10 ASEAN countries, which are organized and received by travel agencies within China, can enter and exit China through the Xishuangbanna Gasa International Airport and other ports of entry without a visa, provided they remain within the administrative region of Xishuangbanna Dai Autonomous Prefecture, Yunnan Province, for no more than 6 days.

Source: NIA

2. State Council Executive Meeting Approves “2025 Action Plan for Stabilizing Foreign Investment”

【Keywords: Stabilizing foreign investment】

On February 10, 2025, the State Council Executive Meeting approved the 2025 Action Plan for Stabilizing Foreign Investment. The meeting emphasized the need to continuously enhance the “Invest in China” brand, increase support for foreign-invested enterprises to reinvest in China, encourage foreign capital to undertake equity investment in China, and optimize the rules and transaction procedures for foreign-related mergers and acquisitions. The meeting also stressed the importance of treating domestic and foreign-invested enterprises equally in government procurement, expanding financing channels for foreign-invested enterprises, and strengthening intellectual property protection. Efforts will be made to provide better services for foreign-invested projects, facilitating entry, exit, stay and residence of foreign enterprise personnel.

Source: Xinhuanet

https://www.news.cn/politics/leaders/20250210/4cbf483916654bcfaf23ec70886f064e/c.html

3. Supreme People’s Court Issues a Reply Clarifying Interest Calculation Standard for Overdue Payments in the Currency of a Foreign Country, Hong Kong, Macao or Taiwan

【Keywords: Foreign currency, Overdue payment, Interest calculation】

Recently, the Supreme People’s Court issued the Reply by the Supreme People's Court on the Standard for Calculating Interest on Overdue Payments in the Currency of a Foreign Country, Hong Kong, Macao or Taiwan. The Reply clarifies that when a party claims interest losses for overdue payments in foreign currencies, if the parties have agreed on the interest calculation standard, the agreed standard shall apply. If the parties have not agreed on the interest calculation standard or the agreement is unclear, the interest calculation standard shall be determined in accordance with three methods. The Reply came into effect on February 13, 2025.

Source: SPC

4. State Taxation Administration Issues a Document to Optimize the Relevant Matters of “Chinese Tax Residency Certificate”

【Keywords: Tax resident, Residency certificate】

Recently, the State Taxation Administration (STA) issued an STA Announcement on Matters Relating to the Certificate of Chinese Residency for Tax Purposes, which optimizes four aspects: expanding the application scenarios of the “Chinese Tax Residency Certificate”, realizing full process online handling, adjusting the content of the “Chinese Tax Residency Certificate”, and shortening the processing time. The Announcement will come into effect on April 1, 2025.

Source: STA

https://fgk.chinatax.gov.cn/zcfgk/c100012/c5238262/content.html

【Shanghai】

1. Shanghai Unveils 13 Measures to Accelerate Development of Lin-gang Special Area

【Keywords: Lin-gang Special Area】

Recently, the Several Opinions of the CPC Shanghai Municipal Committee and the Shanghai Municipal People’s Government on Supporting the Lin-gang Special Area of the China (Shanghai) Pilot Free Trade Zone to Further Deepen High-standard Reform and Opening-up and Stimulate Strong Momentum for High-quality Development was released. The document proposes four specific measures, including aggregating and utilizing global high-end and new factors of production, building a full-chain and full-process scientific and technological innovation system, mapping out key industries with international market competitiveness, and expanding the carrying space for high-standard opening-up.

Source: Shanghai Municipal Development and Reform Commission

2. Shanghai Pilot Free Trade Zone and Lin-gang Special Area Release Negative List for Data Outbound Transfer

【Keywords: Data outbound transfer, Negative List】

Recently, the Shanghai Municipal Cyberspace Administration, along with four other departments, jointly issued the Measures for the Management of Negative List for Data Outbound Transfer in the China (Shanghai) Pilot Free Trade Zone and Lin-gang Special Area (Trial) and the Administrative List of Data Outbound Transfer (Negative List) in China (Shanghai) Pilot Free Trade Zone and Lin-gang Special Area (2024 Edition). The Measures came into effect on the date of issuance. The Negative List covers three areas: reinsurance, international shipping, and trade.

Source: Shanghai Municipal Internet Information Office

3. Shanghai Releases Planning Resource Guarantee Plan to Fully Support the Vigorous Development of New Industrial Enterprises

【Keywords: Planning resources, New industrial enterprises】

Recently, the Shanghai Municipal Planning and Natural Resources Bureau issued the Guidelines on Supporting Industrial Development and Strengthening Planning and Guarantee of Resource Elements (2025 Edition). The Guidelines covers 20 aspects and 55 supporting measures. It allows for the centralized setting of production and living supporting facilities for multiple adjacent industrial land parcels belonging to the same land user, following their identification and incorporation into detailed plans by relevant authorities in charge of industry, ecological environment, and safety.

Source: Shanghai Municipal Planning and Natural Resources Bureau

https://ghzyj.sh.gov.cn/nw2410/20250205/c926c1df2495460f918391c4fd68ca99.html

One Week in Shanghai

【Latest News】

1. “Yu Garden Lanterns Light, Magnolia Flowers Shine Bright” Magnolia Award Winners 2025 Spring Festival Event Held

【Keywords: Magnolia】

On February 10, 2025, the “Yu Garden Lanterns Light, Magnolia Flowers Shine Bright” Magnolia Award Winners 2025 Spring Festival Event was held in Yu Garden. Nearly sixty Magnolia Award winners and their families were invited to enjoy the beautiful lantern displays at Yu Garden and share their New Year wishes together.

Source: Foreign Affairs Office of Shanghai Municipal People's Government

2. Shanghai International Trade Single Window AEO Portal is Online

【Keywords: AEO】

Recently, the Shanghai International Trade Single Window AEO Portal was launched, providing AEO (Authorized Economic Operator) service guide, AEO member directory, online consulting services, pop-up reminders, laboratory test query, and push notifications of AEO cargo identification result, etc. The portal aims to create an online platform to serve enterprises.

Source: Pudong Release

【Forum & Exhibition】

1. The 33rd East China Fair 2025 Shanghai Will Open on March 1

【Keywords: East China Fair】

The 33rd East China Fair 2025 Shanghai will be held at the Shanghai New International Expo Center from March 1 to 4, 2025, with a total exhibition area of 115,000 square meters. It will feature four specialized sub-exhibitions and two specialized exhibition zones, including clothing and apparel exhibition, textile fabric exhibition, household goods exhibition, decoration and gift exhibition, overseas exhibition zone and cross-border e-commerce exhibition zone. This year's East China Fair will also set up a special procurement matchmaking area to provide a platform for buyers and exhibitors to exchange information and facilitate more effective matchmaking.

Source: East China Fair

【Culture & Art】

1. Harry Potter Studio Tour (Shanghai) Project Landed in Shanghai Jinjiang Amusement Park

【Keywords: Harry Potter, Warner Bros.】

On February 12, 2025, Jinjiang International Holdings Co., Ltd announced a joint venture framework agreement with Warner Bros. Discovery Global Experiences, a leading global media and entertainment group, to jointly develop “Warner Bros. (Shanghai) Studio Tour – The Making of Harry Potter” (referred to as "Harry Potter Studio Tour (Shanghai)"). This project will be located in Shanghai Jinjiang Amusement Park and is expected to open for business in 2027. This is the first landing of the Harry Potter Studio Tour in China.

Source: Intl Services Shanghai

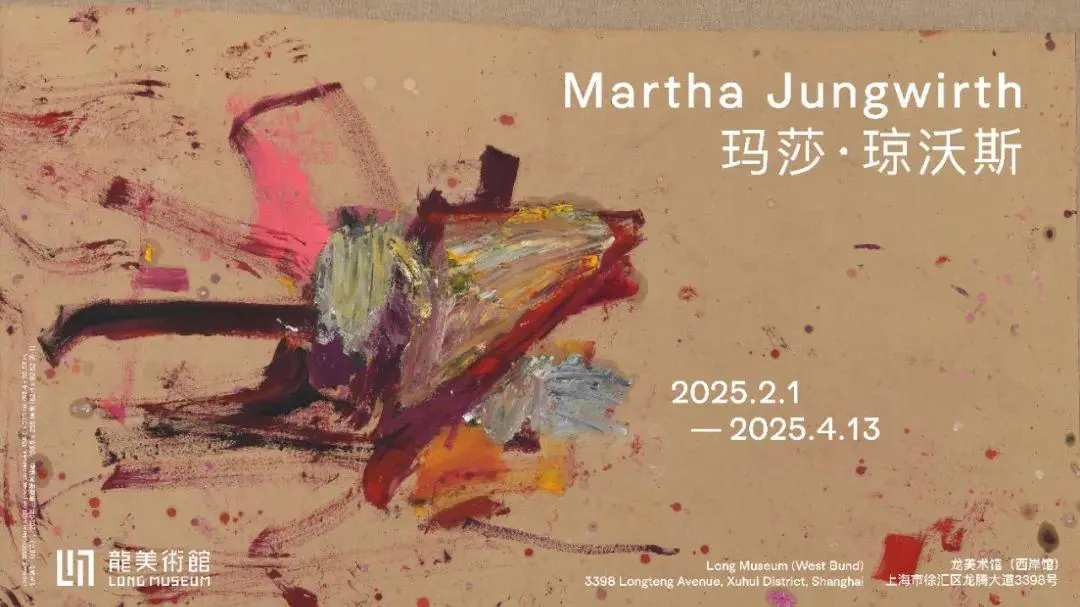

2. Martha Jungwirth: A Solo Exhibition by Austria's Treasured Artist Opens in Shanghai

【Keywords: Martha Jungwirth】

From February 1 to April 13, 2025, the Long Museum (West Bund) is hosting the first solo museum exhibition in China by renowned Austrian artist Martha Jungwirth, titled “Martha Jungwirth”. The exhibition presents 21 paintings created by the artist between 2019 and 2024, showcasing the breadth of Jungwirth’s visual reference materials.

Source: Long Museum

3. The Play “Spring Dawn on Su Causeway” Makes Its Shanghai Premiere

【Keywords: Spring Dawn on Su Causeway】

From February 25 to March 2, 2025, the play “Spring Dawn on Su Causeway” will have its Shanghai premiere at the newly opened Huangpu Cultural Center·Great Shanghai Cinema. Based on the life of Su Shi, a literary giant in the Northern Song Dynasty, the play employs a non-linear narrative structure to recount Su Shi’s achievements during his tenure as the prefect of Hangzhou, including the dredging of West Lake, the construction of the Su Causeway, and the establishment of “Anlefang”, one of China’s earliest public hospitals. The play showcases Su Shi’s scientific approach to governing West Lake and his commitment to the well-being of the people — his efforts culminated in the creation of the iconic “Spring Dawn on Su Causeway”, one of the ten most famous scenic spots of West Lake.

Source: Shanghai Huangpu

【Corporate Activities】

1. Tesla Battery Megafactory in Shanghai Launches Production

【Keywords: Tesla】

Tesla’s energy storage plant in Shanghai’s Lin-gang Special Area commenced operation on Feb 11, 2025, as the assembly line finished the production of the first Megapack unit.

Source: International Services Shanghai

https://english.shanghai.gov.cn/en-Latest-WhatsNew/20250211/b7d9ad02808d4ade949eef453fb5a614.html

2. Gemini Cooperation Begins Operations at Shanghai Port

【Keywords: Gemini, Shipping】

Gemini Cooperation, an operational collaboration between Maersk and Hapag-Lloyd, officially started operations at the port of Shanghai on February 10, 2025. The fleet of the new partnership will consist of around 340 vessels, many ready to adopt cleaner fuels, with a total standing capacity of about 3.7 million TEUs. The shipping service network consists of 29 trunk lines and 30 flexible shuttle lines, with the goal of achieving a vessel schedule reliability of more than 90%.

Source: International Services Shanghai

https://english.shanghai.gov.cn/en-Latest-WhatsNew/20250211/16069a78a8414c908abae6c03501cbad.html

Q&A

Q1:The head of the Fourth Civil Division of the Supreme People’s Court answered reporter’s questions about the Reply by the Supreme People's Court on the Standard for Calculating Interest on Overdue Payments in the Currency of a Foreign Country, Hong Kong, Macao or Taiwan — What are the main contents of the Reply? How is the calculation standard of interest on overdue payments in foreign currencies determined?

A1: The Reply sets out two scenarios for calculating interest on overdue payments in foreign currencies: when the parties have agreed on an interest rate, and when they have not. First, if the parties have agreed on the calculation standard of overdue interest beforehand or reached a consensus on this afterwards, the interest on overdue payment shall be calculated in accordance with the agreement of the parties based on the principle of party autonomy. Since different applicable laws may apply to foreign-related civil and commercial disputes, the laws of different countries have different provisions on interest on overdue payments, and many countries have restrictions on the maximum interest rate, Article 1 of the Reply stipulates that, while respecting the principle of party autonomy, if the agreed-upon interest calculation standard exceeds the upper limit stipulated in the applicable law governing the dispute in the case, the excess portion will not be supported.

Second, for situations where the parties have not agreed on an interest rate calculation standard or if the agreement is unclear, the Reply sets out specific standards for calculating interest on overdue payments in common foreign currencies such as the US dollar, Euro, and British Pound. For the calculation standards of overdue payment interest in other foreign currencies, it is stipulated that they can be determined by referring to the benchmark interest rate of the currency published on the official website of the central bank of the relevant country.

When selecting the applicable interest rate standard for overdue payment interest in a foreign currency, the main factors considered are the authority, wide applicability, and convenience of implementation of the interest rate standard. Taking the common US dollar as an example, the current interest rate standards for the US dollar are mainly: (1) The average interest rate for US dollar loans published in the appendix of the China Monetary Policy Report regularly released on the official website of the People’s Bank of China. The interest rate period is relatively complete, divided into five different periods: within 3 months, from 3 (inclusive) to 6 months, from 6 (inclusive) to 12 months, 1 year, and more than 1 year. This interest rate standard is closer to the actual loan interest rate that enterprises can obtain. (2) The Secured Overnight Financing Rate (SOFR) is a new benchmark interest rate jointly compiled by the Federal Reserve Bank of New York and the Office of Financial Research of the U.S. Treasury Department. (3) The CFETS Interbank Reference Offered Rate (CIROR) is a simple-interest, no-guarantee, and wholesale foreign currency lending rates calculated and published by the China Foreign Exchange Trade System based on quotations from domestic banks with high credit ratings and strong foreign currency pricing capabilities. CIROR, published daily on the official website of the China Foreign Exchange Trade System, is a commonly used US dollar interest rate price in the domestic interbank market and a reference price for pricing US dollar funding costs within domestic banks. After comprehensive consideration and with reference to the suggestions of the People’s Bank of China which is responsible for interest rates, the first interest rate, namely, the average US dollar loan interest rate, shall be used as the calculation standard for US dollar overdue payment interest.

Given the vast number of foreign currencies, it is impractical to list them all. For foreign currencies not specifically mentioned, the Reply stipulates that the calculation of interest on overdue payments can be determined by referring to the benchmark interest rate of that currency as published on the official website of the central bank of the relevant country. The Supreme People’s Court will regularly contact the relevant foreign currency interest rate authorities according to the needs of foreign-related judicial practice and publish the query website links on the relevant website of the Supreme People’s Court in due course.

Source: SPC

Expert Perspective

A New Guide to Data Compliance of Multinational Banks and Financial Institutions: Interpretation of the Regulations on Network Data Security Management

By Zhou Liang, Zhou Jianing (Beijing Dacheng Law Firm)

[Continuing from the Last Issue]

II. The “Regulation on Network Data Security Management” refines rules for personal information processing and strengthen regulatory compliance

5. Emergency Response Plans Should be Activated in the Event of a Data Security Incident

Articles 10 and 11 of the Regulations require that network products or services provided by network data processors comply with the mandatory requirements of national standards. When vulnerabilities occur, remedial measures should be taken immediately, and users should be notified in a timely manner. If national security or social public interests are involved, the competent authorities must be informed within 24 hours. Moreover, in the event of a network data security incident, the emergency response plan should be activated immediately, measures should be taken to prevent the harm from expanding, and reports should be made to the relevant competent authorities in accordance with regulations.

Foreign financial institutions operating within China often possess a large amount of personal data and sensitive information, such as bank accounts, biometric information, medical and and health data, which are largely relevant to financial system stability and public security. The Regulations require network data processors to provide compliant products and services, quickly remedy and report loopholes, and immediately initiate emergency response plans when security incidents occur, which is to strengthen the pre-incident prevention and post-incident handling mechanisms. Foreign banks need to conduct self-inspection and develop emergency response plan. Failure to do so may result in regulatory penalties and, in the event of a data leakage, may lead to a crisis of trust and significant civil liability.

[To be Continued]