Shanghai Weekly Bulletin (Issue 97 No.2, June 2025) ( 2025.06.11 )

Issue 97

Shanghai Weekly Bulletin

No.2,June 2025

Shanghai Weekly Bulletin is an information service presented by the Foreign Affairs Office of Shanghai Municipal People’s Government in collaboration with Wolters Kluwer to foreign-funded enterprises, foreign-related institutions as well as people from overseas living in Shanghai. Covering major national and Shanghai foreign-related news, event information, policy Q&A and interpretations in the past week, it keeps you up-to-date with the latest foreign-related policies and developments in Shanghai.

Laws and Regulations

【National】

1.General Office of the CPC Central Committee and General Office of the State Council Issue Opinions on Improving the Market-based Allocation System for Resource and Environmental Factors

【Keywords: Resource and environment】

The General Office of the CPC Central Committee and the General Office of the State Council have recently issued the Opinions on Improving the Market-based Allocation System for Resource and Environmental Factors. The document sets out 15 specific tasks across four key areas, namely, refining the quota allocation system for resource and environmental factors, broadening the range of tradable factors, improving trading mechanisms, and strengthening trading infrastructure.

Source:Xinhuanet

https://www.news.cn/politics/20250529/0310bbea380b46179ea6d3d912fe614d/c.html

2.Administrative Measures on Tax and Fee Payer Credit Released

【Keywords: Tax and fee, Payer credit】

The State Taxation Administration (STA) has recently issued the Administrative Measures on Tax and Fee Payer Credit, which will take effect on July 1, 2025. The document consists of General Provisions, Collection of Credit Information, Evaluation, Determination and Release of Evaluation Results, Application of Evaluation Results and Supplementary Provisions.

Source:STA

https://fgk.chinatax.gov.cn/zcfgk/c100012/c5240851/content.html

3.China Fully Rolls out “Two-step Declaration” Customs Clearance Model

【Keywords: Two-step declaration, Customs clearance】

The General Administration of Customs has recently issued the Announcement on the Comprehensive Implementation of the “Two-step Declaration” Customs Clearance Model, expanding the application of “two-step declaration” customs clearance model to all customs offices across the country. When handling import declaration procedures, consignees of imported goods or their agents may opt to make a “two-step declaration” of imported goods through the China International Trade Single Window or the integrated online service platform of “Internet + Customs” (https://online.customs.gov.cn). The announcement will come into effect on June 16, 2025.

Source:Customs Release

【Shanghai】

1.Shanghai Customs Introduces 33 Measures to Further Facilitate Cross-border Trade

【Keywords: Cross-border trade】

The Special Action Measures of Shanghai Customs for Advancing Cross-border Trade Facilitation 2025 was released recently. The document proposes 33 initiatives across five key areas, namely, further ensuring smooth clearance for key goods, enhancing the quality and efficiency of cross-border logistics, optimizing regulatory procedures to better align with evolving business models, strengthening connectivity between customs, local authorities, and enterprises, and delivering more targeted services to businesses.

Source:Shanghai Customs 12360 Hotline

2.Shanghai Introduces 15 Measures to Foster a World-class Business Environment by Prioritizing Enterprises Experience

【Keywords: Enterprises experience, Business environment】

In 2025, Shanghai Municipal Administration for Market Regulation (SMAMR) has rolled out 15 measures encompassing 35 reform tasks. These measures focus on benchmarking against World Bank B-READY standards, driving innovation in services for enterprises, optimizing enterprise-related regulatory inspections, and strengthening the guiding role of quality standards.

Source: Shanghai Municipal Administration for Market Regulation

3.Implementation Guidelines to Promote Blockchain-empowered Electronic Trade Document Applications in Shanghai Pudong New Area Issued

【Keywords: Blockchain】

The Implementation Guidelines for Promoting Blockchain-empowered Electronic Trade Document Applications in Shanghai Pudong New Area was released recently. The guidelines apply to activities such as technical support, regulatory guidance, and related management and services in the use of blockchain technology to empower the issuance, transfer, modification, conversion, and storage of electronic trade documents within the administrative area of Pudong New Area.

Source:Pudong Release

One Week in Shanghai

【Latest News】

1.Shanghai Receives 6.48 Million Visitors During Dragon Boat Festival Holiday

【Keywords: Dragon Boat Festival】

During the three-day Dragon Boat Festival holiday, Shanghai welcomed a total of 6.48 million tourist visits. According to statistical estimates, the city’s total tourism spending — encompassing dining, accommodation, transportation, sightseeing, shopping, entertainment, and educational experiences — reached RMB 12.477 billion, marking a year-on-year increase of 3.30%.

Source: International Services Shanghai

https://english.shanghai.gov.cn/en-Latest-WhatsNew/20250603/ffbab623534d40e79eed6de6b749aa28.html

2.AdvaMed Shanghai Representative Office Officially Settles in Qiantan Global Economic Organization Cluster

【Keyword: AdvaMed】

The Shanghai Representative Office of the Advanced Medical Technology Association (AdvaMed), one of the world’s largest medical device industry associations, has recently officially established its presence in the Qiantan Global Economic Organization Cluster.

Source:Pudong Release

【Forum & Exhibition】

1.11th China (Shanghai) International Technology Fair Set to Open

【Keywords: China (Shanghai) International Technology Fair】

The 11th China (Shanghai) International Technology Fair (CSITF) will be held from June 11 to 13, 2025, at the Shanghai World Expo Exhibition & Convention Center. Upholding the principles of “Innovation-driven Development, Intellectual Property Protection, and Promotion of Technology Trade”, this year’s CSITF is themed on “Open Cooperation: Empowering New Productive Forces and Sustainable Development”. The event has set up one themed pavilion exhibition area, one exhibition area for achievement of provinces, autonomous regions and municipalities, four exhibition areas for specific technologies, and two functional areas. It will showcase innovative achievements from nearly 20 countries and regions around the world as well as nearly 20 provinces, autonomous regions and municipalities in China, with nearly 1,000 participating companies.

Source:Shanghai Release

2.AID 2025 Opening soon

【Keywords: Silver Lifestyle Festival】

The International Exhibition of Senior Care, Rehabilitation Medicine and Healthcare, Shanghai 2025 (AID 2025) is set to take place from June 11 to 13 at the Shanghai New International Expo Centre. The event will bring together nearly 500 exhibitors, including leading senior care brands from China and 15 other countries and regions such as Austria, the Netherlands, Germany, and Denmark. This year’s exhibition marks a record scale in terms of participation and exhibition area.

Source:Shanghai Municipal Bureau of Civil Affairs

【Competitive Event】

1.“Maker Shanghai 2025” and the 10th “Maker in China” Shanghai SME Innovation and Entrepreneurship Competition Officially Launched

【Keywords: Maker Shanghai】

The launch ceremony of “Maker Shanghai 2025” and the 10th “Maker in China” Shanghai SME Innovation and Entrepreneurship Competition was recently held, alongside the opening of the selection for Shanghai’s Top 50 Most Promising Startups for Investment. The competition features two categories — Enterprise Group and Startup Group — and will be conducted in stages from May to September, including preliminary rounds, semi-finals, and the final.

Source:Shanghai Municipal Commission of Economy and Informatization

【Culture & Art】

1.“Shanghai Animation Film Studio” Theme Park Opens

【Keywords: Shanghai Animation Film Studio】

The country’s first immersive children’s amusement park centered on classic animation IPs from the Shanghai Animation Film Studio — Popome Amusement Park — has officially opened at Global Harbor in Shanghai. Covering an area of 6,000 square meters, this immersive space leverages technology through games and original designs to bring to life beloved Chinese animation classics such as The Monkey King, Nezha Conquers the Dragon King, and Black Cat Detective.

Source:International Services Shanghai

https://english.shanghai.gov.cn/en-FamilyFun-travelinshanghai/20250604/1616f07432c94e26bc759645a41fdfad.html

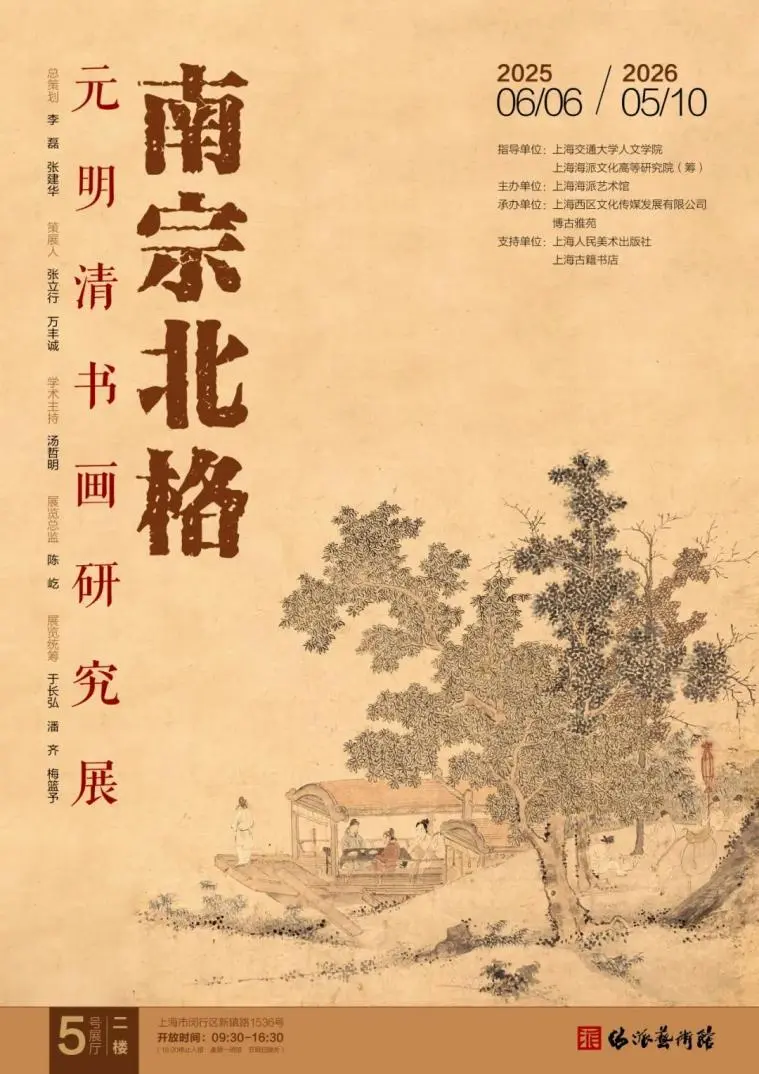

2.Southern School and Northern Style — Exhibition on Painting and Calligraphy of the Yuan, Ming, and Qing Dynasties Opens

【Keywords: Yuan, Ming, and Qing dynasties, Painting and calligraphy】

From June 6, 2025, to May 10, 2026, the Southern School and Northern Style — Research Exhibition on Painting and Calligraphy of the Yuan, Ming, and Qing Dynasties” is on view at the Shanghai Haipai Art Museum. The exhibition brings together masterpieces by renowned masters such as Yao Gongshou, Xu Wei, Dong Qichang, Tang Yin, Bada Shanren, Shitao (of the “Eight Eccentrics of Yangzhou”), Wang Shimin, and Fu Shan. Featuring a wide range of genres — including landscape, flowers and birds, figures, and calligraphy — it showcases the splendid achievements and diverse styles of painting and calligraphy from the Yuan, Ming, and Qing dynasties.

Source:Shanghai Haipai Art Museum

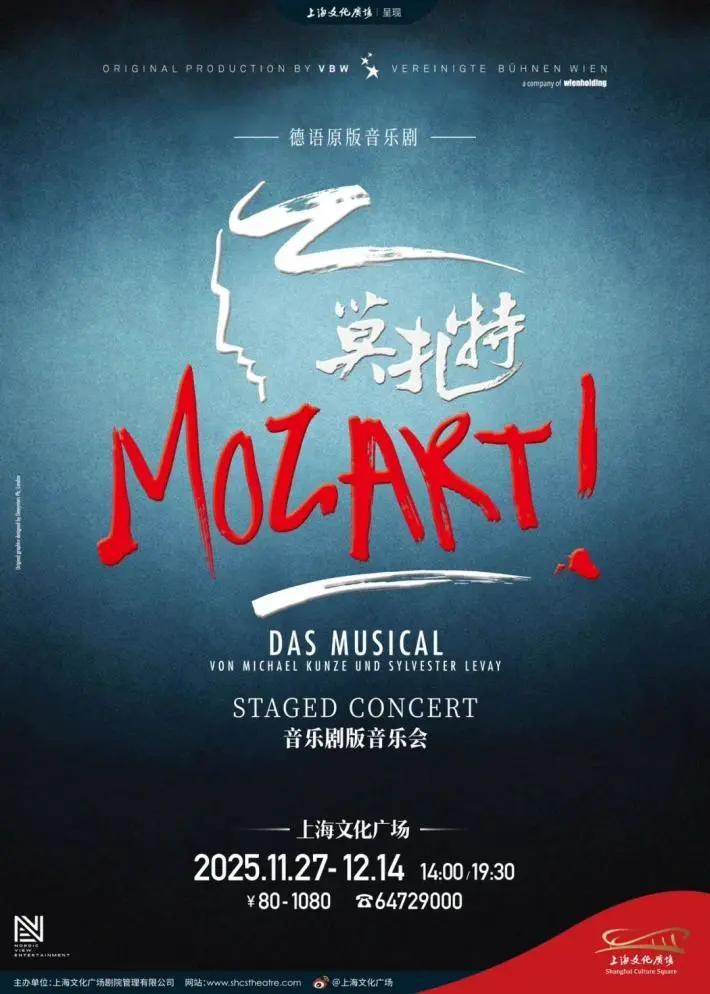

3.Staged Concert Mozart! Returns with a Fresh New Production

【Keyword: Musical】

After a nine-year hiatus, the original German musical Mozart! is set to return to the stage of the Shanghai Culture Square in the form of a newly produced concert-style musical. As the first major production to grace the venue at the close of 2025, it will present 18 spectacular performances from November 27 to December 14, offering long-awaited audiences a musical feast.

Source:Shanghai Culture Square

【Corporate Activities】

1.Porsche China R&D Center Project Officially Established in Jiading

【Keyword: Porsche】

Porsche has recently signed an agreement to establish its China R&D Center in Jiading. The new state-of-the-art office spans over 10,000 square meters and features specialized workshops and a Human-machine Interaction (HMI) laboratory. Designed with an agile innovation culture at its core, the center aims to significantly accelerate development speed and enhance efficiency.

Source:Shanghai Jiading

Q&A

Q:At a recent press conference held by the Information Office of the Shanghai Municipal People’s Government on the 2025 Lujiazui Forum, a senior official from the Financial Regulatory Office of the CPC Shanghai Committee responded to reporters’ questions — The theme of this year’s Lujiazui Forum is “Financial Opening-up and Cooperation for High-quality Development in A Changing Global Economy”. Shanghai has long been a leading hub for financial openness. Could you please share the progress Shanghai has made in financial opening-up and cooperation so far this year? And as we advance high-standard financial opening-up, in which areas will Shanghai continue to deepen reforms going forward?

Q: Openness is one of Shanghai’s greatest strengths, and advancing financial opening-up and cooperation is key to enhancing the city’s competitiveness and influence as an international financial center. In recent years, guided by the central government and supported by the national financial regulatory authorities, Shanghai has steadily promoted financial opening-up and cooperation, becoming the forefront of financial opening-up in the Chinese mainland. The achievements are mainly reflected in four key areas.

First, international financial organizations and foreign-funded financial institutions are rapidly gathering in Shanghai. The International Monetary Fund Shanghai Regional Center and other global financial institutions have established a presence here. Shanghai is home to 1,782 licensed financial institutions, with foreign-funded entities accounting for about one-third of the total.

Second, the variety of international financial products continues to expand. The Shanghai International Reinsurance Center is advancing rapidly, offering six internationally traded products — including crude oil, Technically Specified Rubber 20, low-sulfur fuel oil, international copper, the Shanghai Containerized Freight Index (Europe) futures, and crude oil options — that foreign traders can directly participate in. The cumulative issuance of “Yulan Bond” has surpassed RMB 10 billion, with the Luxembourg Stock Exchange (LuxSE) becoming the first European exchange to list this bond.

Third, cross-border investment and financing channels have become increasingly smooth. Shanghai actively advances pilots for the high-standard opening-up of cross-border trade and investment. Key mechanisms such as “Shanghai-Hong Kong Stock Connect”, “Bond Connect”, “Swap Connect”, “China-Europe Stock Connect”, and the International Board of Shanghai Gold Exchange continue to deepen. The RMB Cross-border Interbank Payment System now covers 186 countries and regions through over 4,900 participating banking institutions worldwide. In 2024, Shanghai accounted for 47% of the nation’s total cross-border RMB settlement volume.

Fourth, Shanghai’s network of domestic and international financial cooperation continues to steadily expand. Financial integration and facilitation within the Yangtze River Delta region have been continuously enhanced. The coordinated development of the Shanghai-Hong Kong international financial center has deepened, while stable cooperation mechanisms have been established with other global financial hubs such as London, Singapore, and Paris.

Going forward, we will continue to work closely with central financial regulatory authorities to steadily expand high-standard financial opening-up.

First, we will better leverage Shanghai as a “testing ground” for financial innovation. Focusing on institutional opening-up, we will establish more financial trading mechanisms and regulatory systems aligned with international standards in the Pudong Leading Area, the Pilot Free Trade Zone, and the Lin-gang Special Area, exploring new paths and piloting institutional innovations for the nation.

Second, we will further expand the achievements of two-way financial opening-up. Adhering to the principle of both “bringing in” and “going global”, we will continuously enhance the internationalization of the financial market to attract more foreign financial institutions to operate and thrive in Shanghai. At the same time, we will implement the action plan for facilitating cross-border financial services, strengthening financial support for enterprises “going global” and the high-quality joint development of the Belt and Road Initiative.

Third, we will better coordinate opening-up with risk prevention. We will actively participate in international financial regulatory exchanges and cooperation, effectively strengthen financial risk management capabilities, and firmly uphold the bottom line of preventing systemic financial risks.

Source:Shanghai Release

Expert Perspective

Equity Investment in the IDC Sector: Industry Overview, Foreign Investment Access and Compliance Pathways

By Zhang Zhewen (AnJie Broad Law Firm)

[Continued from the Previous Issue]

III. Foreign Investment Access

2. Special Rules for Enterprises Directly Listed Overseas

According to the Notice on Issues Concerning the Application Procedures for Domestic Enterprises Directly Listed Overseas to Operate Telecommunications Services, domestic telecommunications enterprises with foreign investment that meet the following conditions shall be subject to the management regulations and approval procedures applicable to domestic-funded enterprises operating telecommunications services:

· the enterprise is a domestic company directly listed overseas or its subsidiary, or a domestic B-share listed company or its subsidiary;

· the foreign shareholding ratio is less than 10% (exclusive); and

· the largest single shareholder is a Chinese investor.

3. MIIT Circular No. 107

On April 10, 2024, the Ministry of Industry and Information Technology (MIIT) issued the Announcement on Launching Pilot Programs to Expand Opening-up of Value-added Telecommunications Services (Circular No. 107). The pilot programs were launched in Beijing’s National Comprehensive Demonstration Zone for Expanding Opening-up in the Service Sector, the Lin-gang Special Area of Shanghai Free Trade Zone and the socialist modernization pioneer zone, Hainan Free Trade Port, and Shenzhen Pilot Demonstration Area for Socialism with Chinese Characteristics.

The announcement removed foreign ownership restrictions on value-added telecom services within these areas, including Internet Data Centers (IDC), Content Delivery Networks (CDN), Internet Service Provider (ISP), online data processing and transaction processing, as well as information services involving information publishing platforms and delivery services (excluding Internet news information, online publishing, online audiovisual, and Internet culture operations), and information protection and processing services. In November of the same year, the telecom authorities of Beijing, Shanghai, Hainan, and Shenzhen — the first batch of pilot areas — issued related policy documents to formally open applications for value-added telecom services under the expanded opening-up pilot.

According to Circular No. 107 and related policy documents issued by the pilot areas, telecom operators applying for the pilot program must ensure that their business registration and service facilities — including leased or purchased infrastructure — are all located within the same pilot area. They are prohibited from purchasing or leasing CDN and other facilities outside the pilot area to provide acceleration services. Given that first-tier cities such as Beijing, Shanghai, and Shenzhen have generally tightened policies on new IDC projects, some IDC providers may find it difficult to meet the requirement of having self-built or self-owned data center facilities within the pilot areas. In such cases, operators may need to align their business plans and seek approval from the regulators of the pilot areas to participate in the pilot program by leasing third-party data center facilities located within the pilot areas.

Notably, neither Circular No. 107 nor the policy documents issued by the pilot areas currently impose explicit regulatory requirements on foreign investors to act as “service providers”. Considering that the qualification requirement under Article 10 of the former Provisions on the Administration of Foreign-funded Telecommunications Enterprises (2016 Edition) — which stipulated that major foreign investor(s) in a foreign-funded telecom enterprise operating value-added telecom services must have strong business performance and operational experience — was fully removed in the 2022 revision, the regulatory approach toward private equity funds and other foreign financial investors investing in IDC enterprises in pilot areas remains to be further observed and assessed by the market.

[To be Continued]