Shanghai Weekly Bulletin (Issue 120 No.4, November 2025) ( 2025.11.26 )

Laws and Regulations

National

1. General Office of MIIT Issues Guidelines for Development of High-standard Digital Industrial Parks

[Keywords: Digital industrial parks]

The General Office of the Ministry of Industry and Information Technology (MIIT) recently issued the Guidelines for Development of High-standard Digital Industrial Parks. The document proposes establishing approximately 200 high-standard digital industrial parks by 2027. The plan aims to achieve full coverage of digital transformation for industrial enterprises above the designated size within these parks and significantly enhance the digitalization level of park management and services. Furthermore, the document seeks to cultivate a batch of replicable and scalable models that demonstrate how digital and intelligent technologies empower park development.

Source: MIIT

https://www.miit.gov.cn/zwgk/zcwj/wjfb/tz/art/2025/art_992172fa3cff4d9ab452fe2ef3f4eee8.html

2. Public Opinions Solicited on Draft Guidelines for Anti-Monopoly Compliance of Internet Platforms

[Keywords: Internet platforms, Anti-monopoly]

The State Administration for Market Regulation (SAMR) recently issued a notice to publicly solicit opinions on the Guidelines for Anti-Monopoly Compliance of Internet Platforms (Draft for Comment). The document stipulates that platform operators must avoid reaching monopoly agreements while providing platform services or conducting self-operated businesses. Furthermore, operators are prohibited from organizing other business operators to reach monopoly agreements or providing substantive assistance for such activities.

Source: SAMR

https://www.samr.gov.cn/hd/zjdc/art/2025/art_8e05960782204036af6b9583f1413378.html

3. Guidelines for Patent Examination Amended

[Keywords: Patent, Examination]

The China National Intellectual Property Administration (CNIPA) recently released the Decision on Amending the Guidelines for Patent Examination. The major revisions include improving protection systems for new fields and new business forms to further stimulate industrial innovation, optimizing examination standards and rules to address pressing issues in examination practice, and formalizing mature practices to better serve innovation entities. The document will come into force on January 1, 2026.

Source: CNIPA

https://www.cnipa.gov.cn/art/2025/11/13/art_66_202561.html

4. NMPA Issues 24 Measures to Deepen Cosmetic Regulatory Reform and Promote High-quality Industry Development

[Keyword: Cosmetics]

The National Medical Products Administration (NMPA) recently released the Opinions on Deepening Cosmetic Regulatory Reform to Promote High-quality Development of the Industry. The document outlines 24 reform measures across five key aspects. It proposes that by 2030, the legal framework for cosmetic regulation will be further refined, the standard system will be more robust, and technical support will be significantly strengthened. Additionally, the industry is expected to demonstrate abundant innovation vitality, comprehensively enhanced risk prevention capabilities, and notably improved quality and safety levels. By 2035, China will establish a cosmetics quality and safety regulation system that meets advanced international standards and essentially achieve modernized regulatory governance. The industry will demonstrate stronger capacity for innovation and global competitiveness.

Source: NMPA

Shanghai

1. Shanghai Issues Recognition List of Overseas Professional Qualifications (Version 3.0)

[Keywords: Overseas professional qualifications]

The Shanghai Municipal Human Resources and Social Security Bureau recently issued the Recognition List of Overseas Professional Qualifications in Shanghai (Version 3.0). The document comprises 139 professional qualifications in Category A, 24 in Category B, 41 in Category C, and 12 in Category D.

Source: Shanghai Municipal Human Resources and Social Security Bureau

https://rsj.sh.gov.cn/trsrc_17739/20251107/t0035_1436657.html

Q&A

SAMR Interpretation of the Guidelines for Anti-Monopoly Compliance of Internet Platforms (Draft for Comment):

Q1

What are the main characteristics of the Guidelines?

A1

The Guidelines adhere to a problem-oriented approach, respond timely to social expectations, and set clear and definite behavioral guidelines for platform operators. The main characteristics are as follows:

In terms of the purpose of formulation, the Guidelines take promoting the innovation and healthy development of the platform economy as the starting point and ultimate goal. The innovation and healthy development of the platform economy rely on a market environment of fair competition. The document details potential anti-monopoly compliance risks for internet platforms and guides platform operators to strengthen their compliance management. By effectively preventing and curbing monopolistic behaviors, it aims to create a fair competitive market environment, fully stimulate the internal momentum and innovation vitality of market entities, and continuously improve the level of competition and quality of development.

In terms of the nature of the document, the Guidelines serve as a special anti-monopoly compliance guide without mandatory force. Effective anti-monopoly compliance can significantly reduce uncertainty costs for platform operators. The document aims to provide general guidance on anti-monopoly compliance for platform operators. Although not legally binding, these guidelines serve as an innovative measure to strengthen whole-chain regulation. They are conducive to helping platform operators accurately identify, assess, and prevent anti-monopoly compliance risks, and proactively regulate their business operations.

In terms of specific content, the Guidelines focus on enhancing the pertinence and effectiveness of anti-monopoly compliance management. Based on the industry characteristics, business models, and competition patterns of the platform economy, the document summarizes experiences in anti-monopoly supervision and law enforcement in a timely manner. It identifies new types of monopoly risks across eight scenarios. Moreover, it guides platform operators to strengthen the review of platform rules and algorithm screening. It also calls for the development of a whole-chain compliance management system to ensure that anti-monopoly compliance is conducted in a targeted and thorough manner.

SAMR Interpretation of the Guidelines for Anti-Monopoly Compliance of Internet Platforms (Draft for Comment):

Q2

How should the eight risk examples listed in the Guidelines be understood?

A2

To assist platform operators in better identifying anti-monopoly compliance risks and to enhance the readability and accessibility of the provisions, the Guidelines list eight types of risks through examples, drawing upon experience in anti-monopoly supervision and law enforcement. These risks include algorithmic collusion between platforms, organizing or assisting intra-platform operators to reach monopoly agreements, unfairly high pricing by platforms, selling below cost, blocking and restrictions, exclusive dealing (often referred to as “pick one from two”), “lowest price across the web” advertising claim, and discriminatory treatment of business users by platforms.

These eight risk examples serve as clear reminders of monopoly risks in specific scenarios of internet platforms. They involve various business activities such as data transmission, algorithm application, service pricing, search ranking, recommendation display, traffic allocation, as well as subsidies and promotions. Platform operators are encouraged to proactively conduct risk assessments and self-inspections based on the examples listed in the Guidelines to avoid the mentioned anti-monopoly compliance risks. However, a conclusion on whether a specific act constitutes monopolistic behavior prohibited by the Anti-Monopoly Law can only be reached following investigation, evidence collection, and analysis in accordance with the Anti-Monopoly Law and relevant regulations.

Source: SAMR

https://www.samr.gov.cn/zw/zfxxgk/fdzdgknr/xwxcs/art/2025/art_62f54cb2ba13412f96bc154e2bff93bb.html

Expert Perspective

Major Revision of Shanghai FTZ Regulations: The Upgrade Path of China’s High-standard Opening-up

By Jiang Fengwen (Chance Bridge Law Firm)

I. Introduction: The Evolution of a Regulation Witnesses a Decade of Tremendous Changes in China’s Opening-up

On September 25, 2025, the 24th Session of the 16th Shanghai Municipal People’s Congress adopted the newly revised Regulations of the China (Shanghai) Pilot Free Trade Zone, which officially came into force on September 29, 2025. This represents the first comprehensive revision since the original Regulations of the China (Shanghai) Pilot Free Trade Zone were implemented over a decade ago in 2014. It signals that the institutional innovation of China’s first pilot free trade zone (hereinafter referred to as the “Pilot FTZ”) has entered a brand-new stage. This revision serves not only as a legislative consolidation of the reform and innovation achievements accumulated by the Shanghai Pilot FTZ over the past ten years but also as a key measure for China to implement the strategy of upgrading Pilot FTZs and to promote high-standard institutional opening-up.

This article will deeply analyze the historical context, core content, and the far-reaching impact of the revision of the Shanghai Pilot FTZ Regulations on China’s high-standard opening-up. It aims to comprehensively present the strategic significance and future prospects behind the revision of this important regulation.

II. Historical Background and Evolution of the Revision to the Regulations of the Shanghai Pilot FTZ

1. Establishment of the Shanghai Pilot FTZ and the Initial Promulgation of the Regulations

The establishment of the China (Shanghai) Pilot FTZ dates back to September 2013. As China’s first Pilot FTZ, it embodies the strategic intent of the Chinese government to respond to the new global economic landscape and build a new system for an open economy in the new era. Prior to the establishment of the Shanghai Pilot FTZ, China’s opening-up mainly focused on creating “policy lowlands” dominated by preferential policies. However, the establishment of the Shanghai Pilot FTZ marked a major shift in China’s philosophy of opening-up: moving from pursuing policy incentives to focusing on institutional innovation, from one-way opening-up to two-way opening-up, and from opening-up in trade in goods to all-round opening-up.

In August 2014, the Regulations of the China (Shanghai) Pilot Free Trade Zone officially came into effect. As the first legislation on Pilot FTZs in China, the Regulations codified innovative systems into law, such as the negative list management model, the “license first, permit later” reform, and the single window for international trade. This provided a model for the institutional development of other Pilot FTZs. Consisting of 9 chapters and 57 articles, the Regulations covered various aspects including the administrative system, investment opening-up, trade facilitation, financial services, tax administration, and comprehensive regulation. It preliminarily established the basic framework for institutional innovation in the Pilot FTZs.

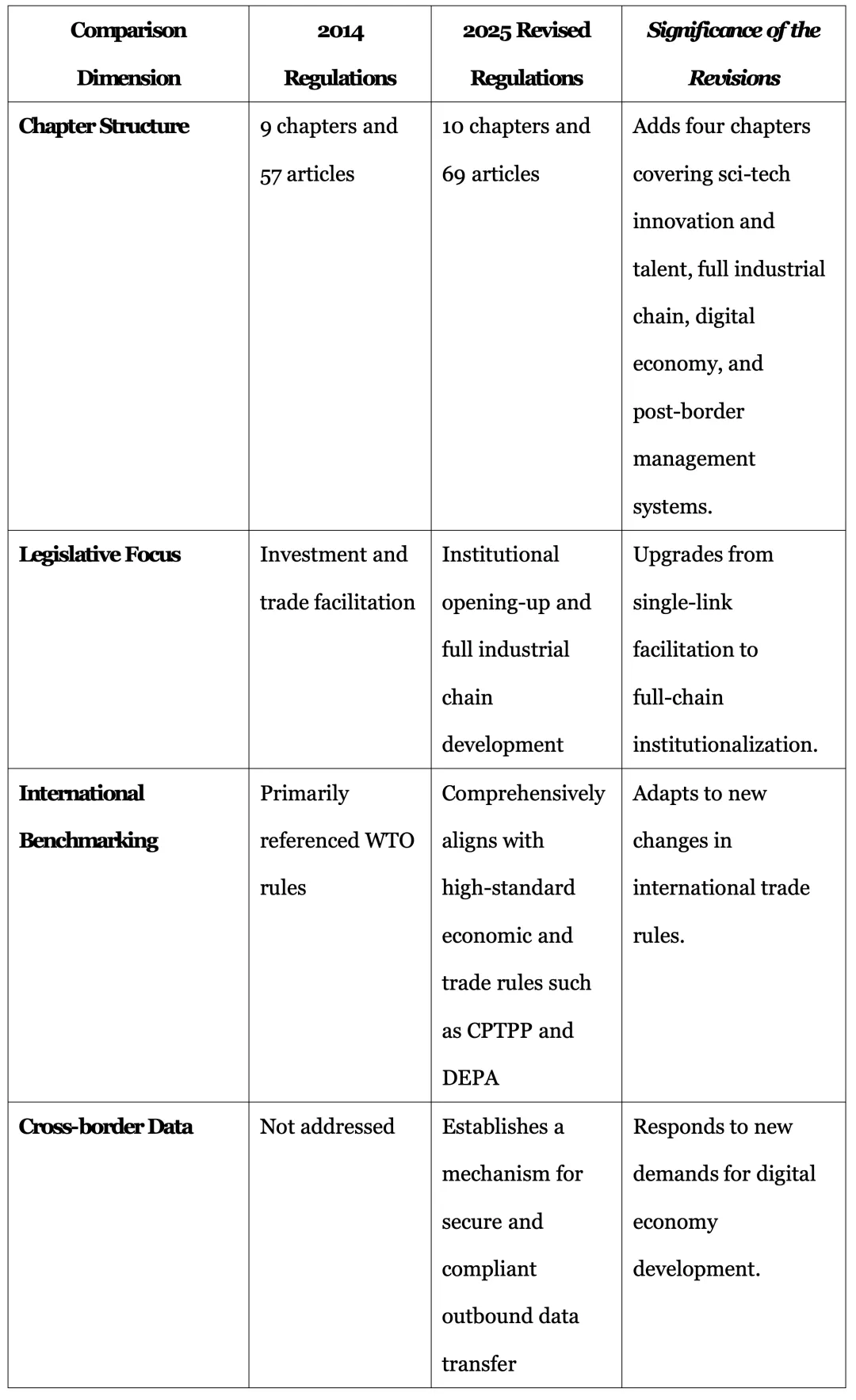

Table: Comparison of the 2014 Regulations and the 2025 Revised Regulations of the Shanghai Pilot FTZ

[To be Continued]

One Week in Shanghai

Latest News

1. Lingang Launches “ToGlobal” One-stop Platform

[Keyword: ToGlobal]

“ToGlobal”, the new brand of the International Data Port designed to support Chinese companies’ global expansion, was officially launched recently. Shanghai Lingang Special Area Cross-border Data Technology Co., Ltd. has partnered with multiple enterprises and institutions to jointly build an international data space ecosystem and a service ecosystem for enterprises going global.

Source: Shanghai Lingang

Corporate Activities

1. Maersk Opens Flagship Logistics Center in Lingang

[Keyword: Maersk]

On November 20, A.P. Moller-Maersk officially opened its flagship logistics center in the Yangshan Special Comprehensive Bonded Zone of the Lingang Special Area. The facility covers a land area of 113,000 square meters and provides a storage area of 147,000 square meters. It stands as Maersk’s largest warehousing investment project in China and one of the company’s largest warehousing investments globally.

Source: Shanghai Lingang

2. Boucheron Opens First China Flagship Store in Shanghai Xintiandi

[Keyword: Boucheron]

The French luxury jewelry house Boucheron recently unveiled its third flagship store globally and its first in China at Shanghai Xintiandi. This opening marks a new stage in the expansion of the brand’s global market footprint.

Source: Shanghai Huangpu

3. Denodo Signs Agreement to Settle in Anting

[Keyword: Denodo]

The Denodo Group recently signed an agreement to launch a project in Jiading District. It plans to establish its global intelligent connected vehicle (ICV) solutions center in Anting town. Once established, the center will serve as Denodo’s premier global innovation hub for industry solutions and extend its services to customers worldwide.

Source: Shanghai Jiading

Culture & Art

1. Exhibition on Ancient Dian Civilization Opens at China Maritime Museum

[Keywords: Ancient Dian Civilization]

The exhibition titled “Evidence of the Dian Kingdom: Special Exhibition of Ancient Dian Civilization of Yunnan” recently opened at the China Maritime Museum. Jointly presented by the China Maritime Museum and the Yunnan Provincial Museum, the exhibition showcases over 200 of the most representative rare treasures from the Ancient Dian Civilization, highlighting significant bronze artifacts. Among the exhibits, 29 are Grade I cultural relics, and precious artifacts account for more than 70% of the total collection. Notably, many of these Dian Kingdom relics are making their debut in Shanghai.

Source: China Maritime Museum